China Going Global: What are the Risks for International Human Rights?

There was a time in which China was an inward-looking country, far from capitalist precepts and from the goal of challenging the first world economy, as is the case today. For almost 30 years since the establishment of People’s Republic of China, the import substitution industrialization was accepted as the only development model. Thus, China’s policy was extremely restrictive towards foreign economic relations and this resulted in low imports and even lower exports, which condemned its economy to stagnation.

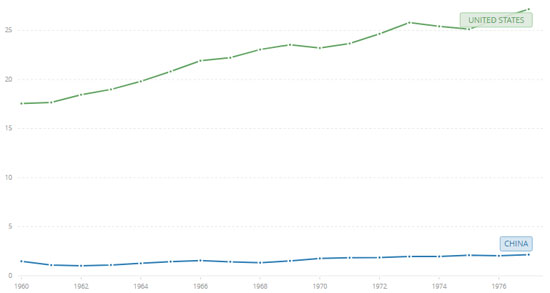

GDP per capita 1960-1977 (constant LCU). Source: The World Bank

The launch of the Open Door Policy by Deng Xiaoping in 1978 represented the turning point by which China started a period of gradual reforms that led to a relaxation of central planning, which entailed the promotion of diversified ownership, and an opening for trade and foreign investment. The economic growth was permitted by the adoption of a pragmatic, gradual and dual-track approach that envisaged the active role of the government in protecting some sectors, while liberalizing the entry into new ones. On the other hand, the liberalisation process was actively facilitated and supported by the government in those industries that were consistent with Chinese comparative advantage, namely the labour-intensive and small-scale traditional sectors, where also foreign firms were allowed to enter.

With the industrial reform, the government granted major autonomy to private firms, which increased in number due to the displacement of State-owned-enterprises (SOE) and the reorganisation of collective firms. The government aimed at reducing its intervention in business operations, while enacting also the contract system and the Corporate Law - which allowed the retaining of profits and the separation of entrepreneurs’ wealth from business’ assets. The ownership transformation announced at the fourteenth National Congress of the CCP soon became a synonym for privatisation and had the effect of reducing the financial burden caused by poorly performing SOEs.

The establishment of Special Economic Zones (SEZs) and the need for external technologies and foreign capital by Chinese private firms brought to the opening of national market to foreign direct investment (FDI). Rapidly, the government liberalised investment policies in coastal areas, thus attracting foreign entrepreneurs, which sought cheap skilled labour. The outcome was that the economic development was circumscribed to those specific regions to the detriment of inland areas. This stressed the need of a more even regional implementation of open policies for FDIs and resulted in the opening of new cities and areas to foreign investors, which had the effect of boosting FDIs towards new regions, thus stimulating the production and exports. This is how in 1990s China started its process to become the major exporter on a global scale.

With its accession to the WTO in 2001, China has been recognised as a major economy. The accession process accelerated the economic integration at both domestic level and in the international market - the reforms allocated more efficiently the resources through the closer alignment to international prices and provided major confidence to WTO members leading to an increase of trade between them and China.

Thanks to the progressive internationalisation of its economy and to the rapid industrialisation, China witnessed a boom in the export sector. Rapid urbanisation contributed to a steep increment of Chinese productivity that resulted in rapid economic growth and increasing share of world production and trade. The compliance with WTO requirements had a positive overall impact on the Chinese economy, whose GDP weight in the world economy has risen from 5.0 per cent to 13.3 per cent in the period 2004-2016.

Chinese success was also possible due to a greater reform in industry and corporate ownership. The establishment of the State-owned Assets Supervision and Administration Commission (SASAC) under the authority of the State Council allowed a major control over SOEs, which were enlisted under strategic industrial sectors, thus enabling their enlargement to huge corporations.

The launch of the Go Global policy made it possible for SOEs to expand into the international environment through foreign Mergers and Acquisitions (M&A), with the primary objective of obtaining access to critical raw materials, resources and energy. The 12th Five-Year Plan (2012-2016) was characterised by a new turn in the investment and outbound investment, which sought new key objectives such as the proactive participation to international explorations of natural resources, the acceleration of technology advancement, the expansion of comparative advantage sectors abroad and the acquisition of internationally renowned brands by qualified enterprises. China then started to explore new markets and opportunities, especially in Western Europe.

The new turn in the outbound investment strategy was due to the 2012 Eurozone economic debt crisis, which weakened China’s trade, due to the excessive reliance on exports to countries financially upset. Another reason that brought China to become an emerging global investor is that investment opportunities within the country were diminishing, while rapidly aging population reduced domestic growth prospects.

Overseas lending plays a crucial role in China’s global investments. Those lending are often directed to countries with poor governance, more as a part of political state-to-state deals than of business relations. The low level of awareness of legal compliance and weak social responsibility damaged the reputation of China as a foreign investor, while Dollar observes that the Asian country has been reluctant to comply with any international standard for environmental and social safeguards, which reflects the non-interference position towards other country’s affairs.

On the other hand, the institution of an alternative source of funding, the Asian Infrastructure Investment Bank (AIIB) represents a response to the existing international institutions that, due to their slow reform process, feed the frustration of developing countries. The AIIB represents an alternative in that it avoids detailed prescriptions for how to manage the process of implementation of environmental and social policies, thus being more attractive for developing countries.

The One Belt One Road (OBOR) is the most ambitious project on a global scale and comprises a huge infrastructure and investment plan that has been designed to enhance the orderly free flow of economic factors, while furthering market integration through the creation of a regional economic cooperation framework. Overall, OBOR links three continents and encompasses more than 60 emerging economies, with a total population of over 4 billion. The lesson learned after the global financial crisis was that an export led economic growth is a risk. That is why China decided to implement an economic integration plan led by infrastructure, with the aim of developing trading partners’ infrastructures through financing projects. Chinese SOEs lead the implementation of OBOR, while the project relies heavily on political cooperation in the forms of regional organisations, ad hoc forums and periodic strategic meetings.

The will to become an autonomous industrial power permitted the launch of Made in China (2025), which aims at securing China’s position in the high-tech industry sector on a global scale through the replacement of Chinese reliance on foreign technology imports with its own innovations and competitive companies. Hence, a major commitment is directed to the investment in technological innovation and smart manufacturing.

But what is the impact of Chinese foreign investments on local human rights? First, it is important to consider that China views all rights as collectively based, non-universal and subordinate to state sovereignty while the collective political right of self-determination of peoples – enshrined in Article 1 ICCPR – has been interpreted as the right of non-intervention in domestic affairs by foreign states against the will of domestic government. The particularity of Chinese conception of rights is their non-fixed character. What is common to the Constitutions is that the rights enshrined are short-term measures to secure a more important right or more of that same right in the long term. More in general, the provision or the denial of certain rights is due to particular economic or political troubles that require a particular policy on selected rights. This is particularly true for civil and social rights that are defined contingent, since they are limited and necessary for the economic development.

After the Tiananmen facts, the government issued the “White Paper”, where it acknowledged for the first time the universality of human rights. China however succeeded in theorising its own vision of human rights by stressing sovereignty, the particular cultural and historical heritage and the economic and social specificities as conditions to assure particular human rights.

Thanks to outward foreign investments, Chinese companies had the opportunity to acquire Western values and practices within the industrial sector. Chinese companies were forced to accept Corporate Social Responsibility (CSR) requirements concerning labour conditions as a prerequisite to compete in the global market. The government guidelines promoted the adoption of CSR through the SASAC guidelines for Chinese SOEs, while several Chinese companies joined the UNGC and committed to the ten principles in the areas of human rights, labour, environment and anti-corruption. Today, the largest Chinese companies publish their CSR reports thanks also to the pressures of transnational human rights activists.

The particular Chinese conception of CSR lies in the fact that Chinese SOEs are affected by the national and particularistic approach towards human rights, which entails a preference for stability and economic growth to the detriment of civil and political rights. The direct control of SASAC over SOEs results in the alignment of the company to the interests of the communist party. The state plays a direct role in choosing which rights SOE’s culture respects, which means that Chinese enterprises are not simply adopting extant understandings of CSR, but they are building their own concept of such responsibility and human rights. One of the most important instruments for human rights protection in business activities is provided by the United Nations Guiding Principles on Business and Human Rights (UNGP), which suggest that states are in charge of taking additional steps in human rights protection for what concerns SOEs. In addition, the UNGP remarks that business enterprises “are expected to respect the principles of internationally recognised human rights” in any situation.

When investing abroad, Chinese firms may adopt some of their home practices. At the same time, some Chinese enterprises apply a more hybrid form of management in their internationalisation processes by perpetuating prevalent Chinese employment practices, as well as replicating successful employment strategies of the acquired firms. The peculiarity stands in the capacity of securing constant access to a pool of cheap and well-trained Chinese workforce, which can be transferred to the acquired company in the host country through an intra-firm transfer system often allowed by foreign immigration policies. These practices can be detrimental to labour rights in the hosting country.

The geographical distribution of Chinese FDIs is linked to specific sectors. In this context, FDIs in the energy and extractive sectors are directed to African and South-East-Asian countries, while investments connected to infrastructures are related to the countries involved in the OBOR project. In these sectors, there is a higher possibility of witnessing a violation of labour rights - due to companies’ inexperience and due to the transfer of specific Chinese working conditions that are not in compliance with international standards – and of human rights more in general, because of bad governance and of a bad human rights record of the target country. In particular, when those investments are detrimental for the ecosystem and for the people living in it there is a possible violation of the right to self-determination and to an adequate standard of living. Even basic rights are more at risk when this kind of investments are likely to cause an armed conflict between the government and weakened groups. The precarious working conditions favoured by Chinese SOEs - such as the preference for Chinese workers at the expense of local ones, long working hours, low salaries and bribery over labour disputes – are in contrast to the scope and principles of the ILO Declaration on Social Justice for Fair Globalization.

On the other hand, the hi-tech sector is linked to Europe as a target of Mergers and Acquisitions. Thanks to the development of a light-touch approach, Chinese companies generally do not apply domestic standards in the human resource management, even if the most common practice is the transfer of Chinese expats overseas. One risky home-country effect for European labour is the underestimation of the role of trade unions by Chinese managers, which can lead to an increase of working hours without an increase in salary, or in a deterioration of security at work. However, the hi-tech sector is less likely to be subject to violations of labour and human rights. Chinese companies acquiring European firms are willing to respect existing rules and labour standards, since they learned that those are the key driver for successful investments. The aim of the acquisitions is the know-how of the European companies, which is necessary for the enhancement of Chinese firms.

Even Europe is not exempt from mismanagement and labour rights violations in the infrastructure and logistics sector investments. The case of COSCO’s acquisition of Piraeus port stressed how the aim of continued growth, improved productivity and increase in the number of jobs has been fulfilled by the Chinese company, but the suppression of logistic costs and productivity enhancement is passed down to the workforce. This resulted in precarious work, longer working hours and less democratic power, which can lead to a drop in safety and health measures that can affect negatively the entire social community that relies on these jobs.